Insights from my interactions with key stakeholders in the assisted fertility industry as I try to navigate the trends shaping the industry in general.

Read MorePhoto by Tuva Mathilde Løland on Unsplash

Photo by Tuva Mathilde Løland on Unsplash

Insights from my interactions with key stakeholders in the assisted fertility industry as I try to navigate the trends shaping the industry in general.

Read More

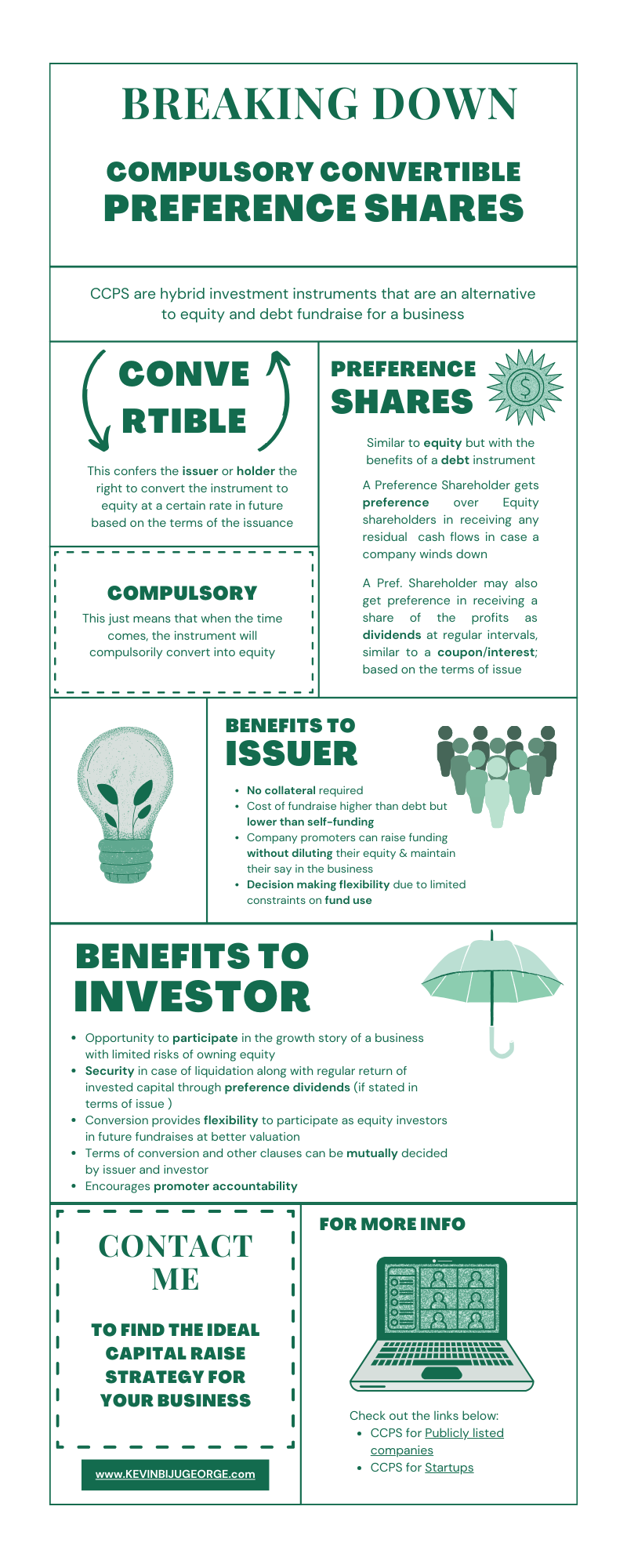

What are Compulsory Convertible Preference Shares and how do they work? Find the answer to such questions and more in this educational series and save the infographic for future use.

Read MoreThis blog post is part of a series on things I learnt as a junior Investment Banker. If you're interested to follow the previous blog post, you can go here.

Photo by Hunters Race on Unsplash

I am biased to believe that one’s yardstick for success in any field is greatly determined not by the strength of their abilities, but by the rigour of their habits. In pursuit of building the latter, I want to offer more practical lessons that would be helpful for my future self and for any reader who may be interested to learn further about what it takes to be an Investment Banker.

Learning #3: Be prepared for anything

Someone senior to me once gave me wise words of advice- "It's never done until the money hits the bank". Truer words have not been spoken. Within whatever brief time I've already spent in the business, I've witnessed enough moments to realise that a deal could fall through at any moment. Sometimes it can be avoided, other times it can't. One thing is for sure, it stings every time.

If you've watched enough TV shows or attended career seminars, you will hear at least one person compare Investment Banking to a high-stress situation like a war-zone . I used to laugh it off earlier, but now I don't. IB is no less than being in the firefighting business when it comes to the mental fortitude required in dealing with fires. Those that assume otherwise, get burned (pun intended).

You probably have no idea what is going on behind a senior Banker's pleasant, smiling demeanour when you interact with such a person. Most senior Bankers I have met have gotten to where they are because of their ability to control stress and excessive emotional swings and continue to work like it is a fine day to be alive regardless of how the day actually is.

***

A general note to incoming freshers- most things I say in this series will probably be relevant to other allied career roles like Management Consulting and even to CXO-level professionals. I thought you should know because these professions share similar characteristics by virtue of being in the same ecosystem as I mentioned in my previous blog post.

***

It makes sense, therefore, to be prepared for anything at all times. There's a lot of shock and awe involved on a regular basis in this line of work so it is best to remain unfazed by any and all distractions, grandstanding, peacocking, filibustering, hard-balling during negotiations and submissions that either parties of transaction may be involved in. Be grateful on the good days, and keep your chin up on the bad days- you build a thicker skin over time anyways.

How to build mental fortitude to handle unexpected exigencies?

I have two suggestions that aren’t originally mine:

The OODA principle- I don't know who the original theorist behind the idea is, but I heard it from Jocko Wilink. OODA- Observe, Orient, Decide and Act is used by US Navy SEALs and other elite forces to eliminate/minimise the effects that brain fog creates in the moment in a high stress situation. Feel free to read more on the topic.

Learning from hindsight- This is a ritual we follow at my firm. At the end of every major deal, the VP and the Analyst or Associate leading the mandate gets to present their learnings and present any recommendations to deploy best practices for future mandates by evaluating their experiences in hindsight. The collective knowledge from the learnings of our peers (even at the juniormost levels) help us to defuse any 'sparks' before they even turn into fires. Why not use the same principles for your own self?

The next suggestion should be obvious to you by now.

Learning # 4: Take care of your physical health

Anybody in this line of work would relate that Investment Banking is tough business but luckily it is cyclical. There will be periods of lull (like the one I am using right now to pen down this note) as well as days when you are drowning neck-deep in work. It is your prerogative to ensure you are able to deal with stress at all times and that requires being physically healthy.

There will be times when prioritising health may not seem appropriate or worth it, but all bad habits will eventually catch up to you. Lack of proper sleep, inappropriate eating habits and schedules, along with myriad other bad habits that people near you tend to wear as badges of honour aren't actually all that glamourous.

I want to keep this lesson short. Ensure you keep yourself active consistently and get enough rest despite your schedules because it is vital if you want to keep working at high efficiency.

If that isn’t enough reason to stay healthy, do an observation exercise for yourself: notice what % of the uber-rich people you meet are overweight/obese. My personal observation suggests it is low. Rising obesity related to food insecurity/poverty is already a problem in developed countries, and is a trend increasingly evident in developing nations like India as well. Being fit is a status symbol for the rich- if you want to join them, be like them.

That’s it for this blog post.

* * *

Like what you see or want to discuss something? Connect with me on LinkedIn or see the contact page for more ways to contact me.

This blog post is part of a series on things I learnt as a junior Investment Banker. If you're interested to follow the next blog post, you can go here.

Photo by Hunters Race on Unsplash

Hello world,

As I complete two years in my journey as an Investment Banker, I want to take this opportunity to pen down a few thoughts about things I have learnt as I celebrate yet another anniversary in this profession.

Over a series of blog posts, I’d like to offer my thoughts and observations about what it is like working in Investment Banking (IB) from the perspective of a fresher- having started as an Intern myself, to being an Associate today. Having observed the entropy in my journey so far, I suspect that at least some of my current opinions and observations will be grossly inaccurate over time.

Nonetheless, taking inspiration from Albert Goldman’s Lindy effect (later popularised by Dr. Nassim Taleb), I want to see how many of my current ideas stand the test of time. So here goes:

Learning #0: Setting expectations:

Investment Banking (and to a larger extent- a career in Finance) is a selective profession. It isn't easy to get into a good role without the right connections and credentials.

Moreover, the decision to quit after putting in a few years in the business also requires considerable thought- given the attractive monetary rewards and lifestyle associated with being so close to “power”; political and social capital that you also tend to accumulate along with financial capital.

I have also come to realise that IB and the larger ecosystem of Private Equity/ Venture Capital (PE/VC), Consulting, Corporate Finance and Strategy professionals is a small world. You tend to know and meet everyone and you should assume everyone has heard about you sometime as you rise in seniority within the industry.

To give you a sense of just how small this world could get, I’m sharing below a mind map of a select group of firms and PE funds actively investing/invested in the healthcare delivery space in India. By no means is this information exhaustive but it gives you an idea of the complex interconnections you could find once you dig deep enough.

Mind map showing active investors in the healthcare delivery space in India.

NOTE: The aforementioned image may be inaccurate in certain cases with respect to the latest transaction stats. While I make my best efforts to keep the mind map updated, readers are encouraged to consider the image for representative purposes only.

A close-knit community comes with its own upsides and downsides, and is a topic that is best left for discussing another time.

But there’s one thing I would highly recommend everyone do on an ongoing basis:

Learning # 1: Know thyself and thy place

It is imperative that you identify you and your firm’s role and hierarchy in the grand scheme of things, aka the ecosystem that is built around this business.

As with any competitive endeavour involving humans, this industry operates like a inverted funnel-there are few at the top and many at the bottom. Conversely, deal flow works like a funnel- the few get to pick the best harvest in terms of deals, while the many compete for the less interesting picks left over by the former. The race to get to the top is real and perennial; and the system is unlikely to change soon. Best to accept facts as is.

AI generated image

Perhaps you’re wondering why bother engaging in this fact-finding exercise- here’s why. If by the end of the process you find that you are among the top- good for you; now manage sticking at the top. But if you aren't at the top, you have to decide if you want to get to the top and choose your next steps accordingly.

The earlier you complete the process, the better it is. Moreover, the marginal effort required to update your knowledge about your relative position requires only that you keep abreast of the latest market developments.

Which brings me to my next suggestion:

Learning #2: Market intel compounds with time:

This idea is still a work in progress in my head but the structure is good enough to understand what I’m trying to convey.

I suspect that market intelligence is a tool in one’s arsenal that only gets stronger and more lethal with time. And it is your prerogative to ensure you have the most relevant intel at all times.

You might be wondering perhaps what market intel is. Vaguely put, it is what I call General Knowldge+ (GK+). The plus “+” signifier is key here, in the sense that it confers qualities to GK that is over and above the inherent information that GK contains- akin to what Disney+ is to Disney or what ESPN+ is to ESPN. The only caveat to my analogy is that while one could acquire GK through the investment of money, GK+ is often derived through the investment of time. Market intel isn’t handed to you on a platter- it requires dedicated effort to develop and grow with time.

As an Analyst, it is your ability to distill disorganised pieces of data, often from diverse sources, into one coherent picture that yields market intel. It is like building your inner Spidey Sense, one which when built with consistent effort, puts you ahead of competition and often leaves them bewildered wondering what your secret-sauce is.

AI generated image

The sources of such data are of various kinds- from the seemingly mundane to market-moving information, often covering disciplines unrelated to Business at all. The following is an inexhaustive list of data sources that could yield market intel:

nuances about Business Models- pricing, costing, processes, best practices;

a Rolodex of key decision makers and the right kinds of people;

History of deal making and the politics surrounding deals;

Valuation multiples and its trend over business cycles;

Consensus macroeconomic sentiment and market psychology;

Market chatter/gossip about people or any funky business (sometimes very relevant), including recent job changes;

Tax Agency/Government raids, Regulator fines, penalties, lawsuits, and offences pronounced; and

Familiarity with Legal grey-areas (even loopholes) and laws of the land/industry, including any new laws.

Each of the aforementioned sources may have greater importance over the others depending on which part of the business you work in. But they are all important nonetheless.

It should be obvious but I want to be clear- you don't need to be an expert in every non-business field mentioned above. You depend on specialist professionals with specific expertise for those. But you need to know who to get in touch with in order to source that data that you require. Most investment bankers would safely claim to be a jack of many trades, but they are also masters of one- analysis.

Why is market intel important to your firm?

Being in the sell-side often means you’re ‘pushing’ services instead of pulling clients inward. In a dynamic market, it pays to build your market intel because it gives you the ability to sense the winds of change and sniff deals in the making before they happen. Time often brews events and serendipity in unimaginable ways to make deals happen which were hitherto unviable. Timing is often a more critical element to deals than the valuation methods used and any transaction structures you can concoct.

Any informational advantage you have gives you an edge over your competitors because it is directly related to your ability to bring inward business in future as you grow up the ranks within the firm.

Information asymmetry is real and prevalent. Best to accept facts as is.

Although one is expected to be more focused on executing mandates as a junior in the team, I suspect that good banks encourage juniors to gather market intel as early as possible in order to groom future leaders and managers of the firm.

Why should market intel be important to you? Few reasons:

a) Piecing together market intel from various sources is fun

b) It shows your boss that you are competent and you have a network of people (friends, ex-colleagues, favour-bound confidantes, etc.) outside of work. This comes in handy more often than you'd expect.

c) Forcing yourself to source market intel prevents you from missing the forest for the trees. More on why this is important later.

How do you gather market intel? Two ridiculously simple things to write but super hard to implement consistently.

Start reading with the goal of retaining information

Build your network with the intent to allow your network to prosper from you

I would encourage anyone interested to look up Mosaic Theory under CFA Institute curriculum to learn more about the topic.

That’s it for this blog post. More to follow soon.

* * *

Like what you see or want to discuss something? Connect with me on LinkedIn or see the contact page for more ways to contact me.

This article is part of a series I wrote on my takeaways from the First CFA Society India Insurance Conference 2021. To read the rest of the articles, head over to my Blog page and search for #IInC.

Read MoreThis article is part of a series I wrote on my takeaways from the First CFA Society India Insurance Conference 2021. To read the rest of the articles, head over to my Blog page and search for #IInC.

Read MoreThis article is part of a series I wrote on my takeaways from the First CFA Society India Insurance Conference 2021. To read the rest of the articles, head over to my Blog page and search for #IInC.

Read More