NOTE: Views expressed herein need not be those of my employer. Readers are advised not to attribute my comments in any way, shape or form to anybody else.

As an investment banker, I’m often privileged to work with businesses defining their industry segment. One such segment is a niche within the broader healthcare delivery industry that has witnessed significant developments in recent years, both in India and worldwide- that of Assisted Reproduction, more commonly known as Fertility Services in India.

Through this blog post, I wish to share insights from my interactions with key stakeholders in the industry- the healthcare professionals as well as investors as I try to navigate the trends shaping the industry in general. I will try to limit my observations to India as much as possible, except wherever global examples offer more context and relevance.

Setting context- the rise of Infertility in India:

India has come a long way from using traditional medicines and ritualistic practices to treat the inability to conceive, medically known as infertility. About three decades after India’s independence, the first test-tube baby was born in 1978 in India using a process known as In-Vitro fertilisation (IVF), a procedure that now is a subset of the broader umbrella term Assisted Reproduction Technology (ART) that is more commonly used by medical professionals today. ART in its current avatar is a highly specialised science and is at the forefront of tackling infertility issues using targeted methods that address specific issues related to conception.

According to the Indian Society for Assisted Reproduction (ISAR), the incidence of infertility (defined as the inability to conceive after more than 1 year of regular unprotected intercourse) is as high as 27.5 million people, which translates to one in six infertile couples of reproductive age in India. This number is on the rise due to a number of factors: some due to natural causes and others that are lifestyle-induced; such as the rise in obesity, alcohol consumption, smoking, and stress.

Herein lies an interesting conundrum: while the advancements in ART have unlocked a technology previously unavailable to many infertile couples, its availability and growth have also led to unintended consequences as a result of how modern society is organised. Many modern couples are consciously opting to delay pregnancy as long as possible in their pursuit to thrive in their work careers before “settling” down. Delayed pregnancy is a trend concurrent with the rise in female literacy, female labour force participation (both in the developed and the developing world, including India) and the rise of the SHEconomy, a topic discussed in great detail by Morgan Stanley.

This observation is worth noting given the popular rhetoric of the 'demographic dividend' that marks India's current decade of economic growth. India now has the highest percentage of working-age youth ever, but it is slowly ageing- similar to trends previously observed in countries such as Japan, Western Europe, and most recently China. The country has already reached replacement levels for the population and is trending downwards. Assuming nothing changes, one would be safe to extrapolate that there will be increased use of ART treatments in the future.

Why is Private Equity interested in the Infertility business?

In recent years, Infertility has emerged as an interesting segment for Private Equity investors looking to deploy capital within the broader Healthcare and life-sciences industry. Following are some reasons in no particular order beyond the macro factors previously mentioned:

Specialised workforce in acute supply:

Regardless of the statistic used, if one believed the supply of Health professionals in India was acute, Infertility doctors and associated medical staff are in even shorter supply. And more so; in rural areas. The Indian Society for Assisted Reproduction (ISAR), a professional association representing ART specialists, Gynecologists, Embryologists, ART Technologists, counsellors and para-medical staff counts close to 4,000 members all across India. The green shoot is, however, that this figure is steadily rising.

Quirks of the Sales Funnel:

More often than not, infertile couples tend to realise the need for intervention later than is ideal for a natural conception, an observation backed by multiple studies pointing to a lack of fertility awareness [1,2]. The anxiety of racing against the ticking biological clock, exacerbated by the difficulty in discussing such intimate matters with loved ones, often lead modern couples to seek help online. It follows then that doctors with the best track records (read: success rates) and ability to maintain a notable digital presence tend to pull the largest share of patients to their clinics. Therefore, the ‘pull’ factor for patients in this segment is more doctor-driven versus being operator/brand-driven.

Telehealth & digital consultations have only mitigated the physical limitations that doctors had in catering to their patients earlier. With physical proximity no longer a barrier, doctors with the best success rates have the potential to tap into markets they previously couldn’t. The competitive plane now rests on both success rates and optimised digital presence, which is a function of bigger marketing budgets.

The promise of Scalability:

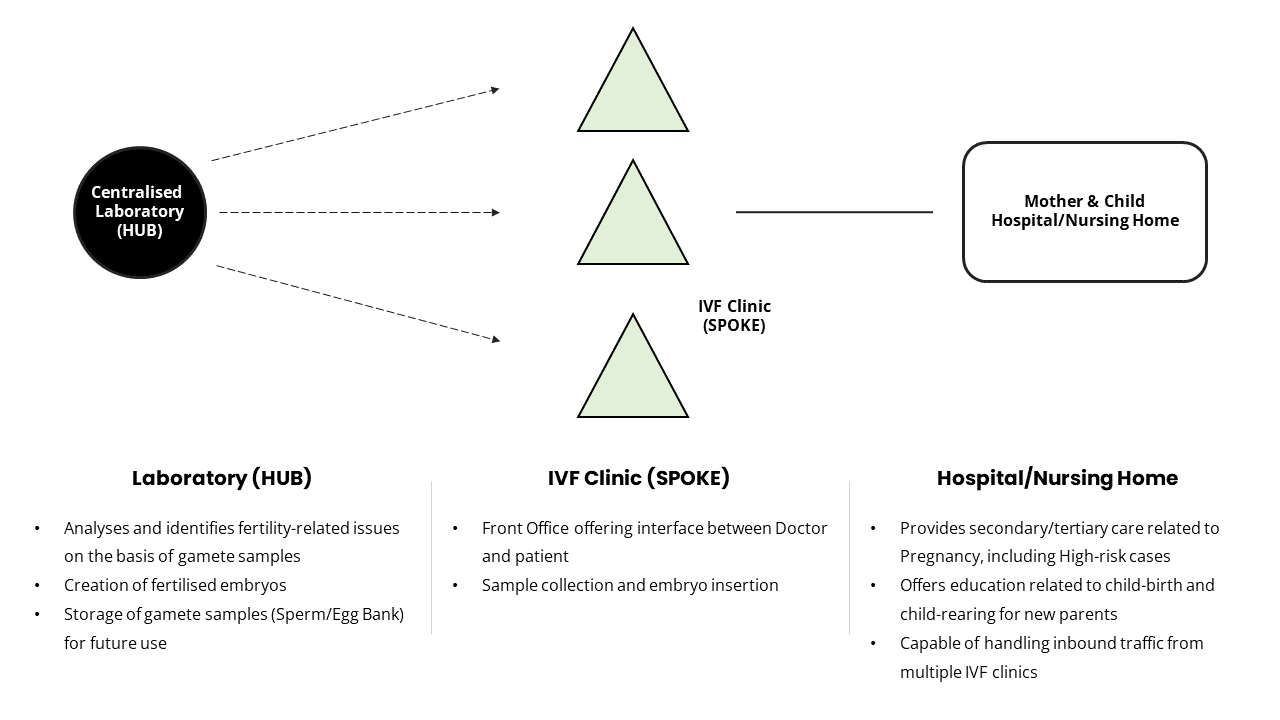

ART services need not be provided alongside acute care facilities inside a hospital environment, similar to other non-critical care segments such as dermatology (skin), trichology (hair), and ophthalmology (eye). This makes Fertility clinics highly suitable to operate in a ‘hub-and-spoke’ model, a strategy already adopted by large players in the segment. The following illustration showcases how multiple consultation clinics could depend on a centralized laboratory/gamete storage facility within a specific geography- acting like the ‘spokes’ to a ‘hub’, a model neatly deployed in the supply chain & logistics industry previously.

Illustration: The Hub-and-spoke operational framework for ART service operators and associated roles of each node in the value chain. Please note this is relevant for India and may not be for other countries.

The model lowers the burden of high capital expenditures (capex) per clinic while maintaining similar operating margins. Therefore, payback periods at the unit level are much lower (<1-2 years) when compared to setting up a typical hospital. What is even more attractive for large operators is the maneuverability to set up clinics in high-traffic areas [often in high streets with much higher rents per square foot (rpsf)] which may not be commercially viable otherwise. These front offices, akin to anchor stores in malls, offer sufficient Above-The-Line (ATL) marketing presence in high-traffic areas so as to allow offsetting those budgets elsewhere.

Cost Differential and headroom for growth:

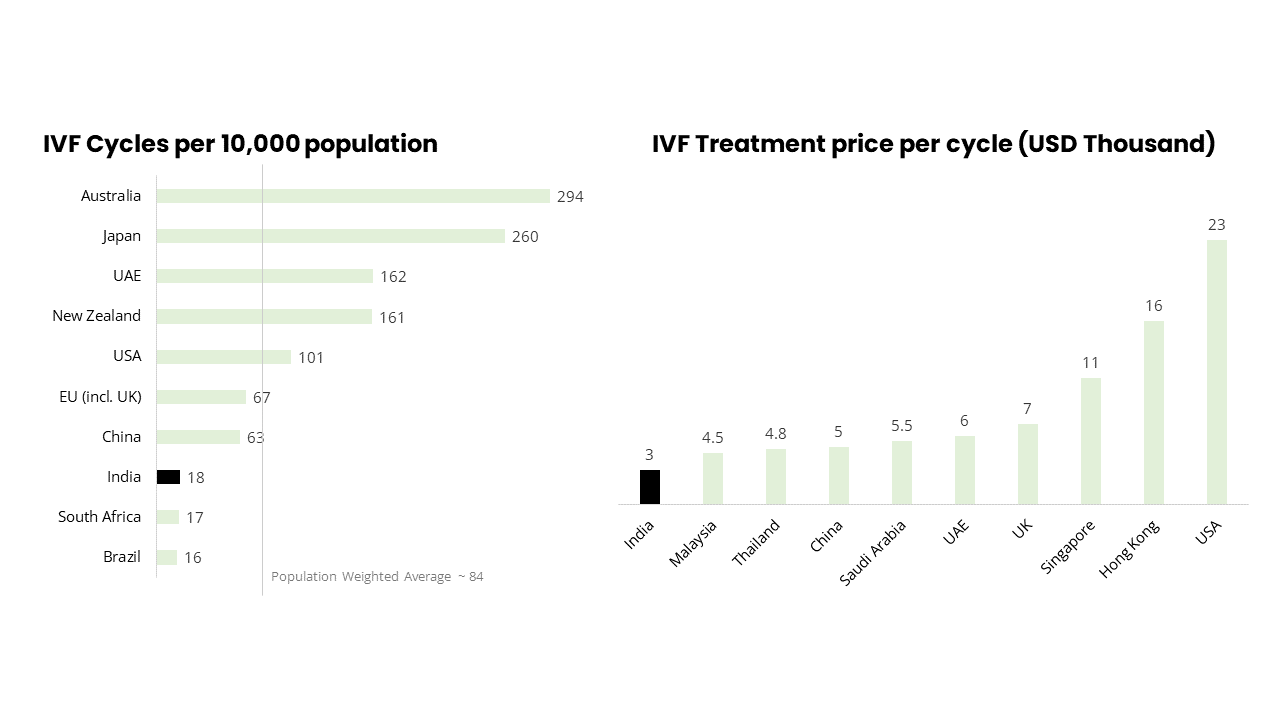

Lowest treatment rates in APAC and Middle East as per this Lincoln International report leading to hightened interest from international and domestic hospital operators

Regulatory Crackdown & boon of formalisation:

The enactment of the Assisted Reproductive Technology (Regulation) Act in 2021 brought long-awaited reforms into the regulation of ART clinics and the Surrogacy market across the country. This is important because earlier, State governments had greater discretion on enforcement given that ART and Surrogacy were treated on par with ’public health’ under the State concept of the Indian Constitution.

The introduction of the law brought clarity on many legal grey areas and a clear hierarchy of enforcement via both national-level and state-level authorities under a federated structure that empowers them to take penal actions against violations and illicit oocyte (egg) racketeering, a market that was thriving in many parts of the country until recently.

Moreover, the formalisation of the economy, including the introduction of Good & Services Tax (GST), have only made matters worse for smaller clinics operating a sizeable cash component in their business, which was very common earlier. Compliance is increasingly becoming a mammoth task diverting attention from clinical matters for smaller chains already operating on shoestring budgets. Many small clinics that haven’t wound down already are now facing an existential crisis against the backdrop of a regulatory crackdown and are trying to organise and scale operational compliance as quickly as possible.

How is Private Equity investing in the Infertility business?

Before I can answer the question above, I want to offer some context into how PEs viewed healthcare investments in India so far. The earliest PE entrants in the pre-2010s era in India found greater comfort investing in multi-specialty operators since the market was still in its infancy. That strategy turned out to work well as each of their portfolio companies (PortCos) grew into the biggest players in the country. With time however, inorganic growth in the multi-specialty space has become increasingly difficult for the PortCos given there aren’t enough smaller multi-specialty hospital units (for simplicity sake, hospitals with 150+ beds) to acquire.

Organic growth (via capacity addition) takes longer and isn’t the strategy for PEs.

Thus, the emergence of single-specialty consolidation play.

It would be redundant were I to claim that the healthcare business is undergoing consolidation. The high base effects of the pandemic have started to wane and the era of easy money for ‘high-burn’ business models is over. Much has already been churned in the news cycle so I won’t be adding any new insight when I mention the rampant consolidation taking place. In fact, I alluded to the incoming wave in a previous blog post indirectly, a summary of which I’m happy to share for the new reader below:

What is interesting, however, is the nature of deals- specifically in the context of the Fertility segment. My observations suggest Private Equity has taken a clear stance on playing the Fertility segment as a single-specialty platform-play resting on vertical integration vis-à-vis the multi-specialty-growth play that focuses more on lateral integration.

More likely than not, deals in the fertilty segment in India are also control deals with greater say in scaling the business before the investors can expect an attractive exit.

Strategies deployed by PE investors across multi-specialty brands versus Fertility brands.

All the biggest players in the segment are PE-funded (Indira, Nova, Oasis, CloudNine/C9) with the latest entrant being Ferty9 (which is Verlinvest’s first healthcare investment in India). I see further competition rising as a result of new entries from PE-backed hospitals that have also entered this space. My conclusion therefore, is that consolidation is inevitable as the race to capture market share has already begun.

Prognostication:

How do I view consolidation occuring, you ask? I belive the market will consolidate first in south, west, north and east- in line with per capita GDP by state. You pick low-hanging fruits first.

I’m curious to see how my prediction plays out.